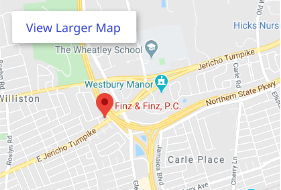

If you’ve been injured in a car accident, you may be wondering what to do next, especially if insurance companies are involved. In New York, you will most likely turn to your personal injury protection (PIP) policy to obtain coverage for your medical expenses and your lost income if you aren’t able to work while you recover. As a no-fault state, New York state law requires every motorist to carry at least $50,000 of PIP coverage.

If you were seriously injured in a car accident caused by someone else, you might be able to step outside New York’s no-fault system and file a third-party insurance claim directly against the at-fault motorist. Whether you are filing a claim with your own PIP policy or the at-fault party’s insurance company, you will have to interact with an insurance claims adjuster to obtain the financial relief you need.

The most important thing to remember about insurance companies is that they are for-profit entities. Insurance adjusters are trained to use various tactics to poke holes in your case. Their ultimate goal is reducing or denying your claim.

Below, we’ve included some crucial tips for protecting your rights when speaking with a claims adjuster. If you have further questions, contact a knowledgeable New York car accident lawyer at Finz & Finz, P.C. to discuss your claim.

Be Polite

Whether you are pursuing a claim with your own insurance company or the at-fault driver’s insurance company, the process can be time-consuming and stressful, particularly if you are still recovering from serious injuries.

Still, being impatient and getting frustrated with the claims adjuster won’t make the process any easier for you. When speaking with insurance adjusters, do your best to be as cordial as possible, as this may help avoid unpleasant interactions and expedite your injury claim.

Ask for the Insurance Adjuster’s Name

You should always ask the claims adjuster to identify themself by name. When talking with insurance reps, you should also ask the claims adjuster for their phone number and the business address. Make sure you do this every time the insurance company calls.

Only Provide Basic Personal Information

Remember, insurance adjusters are trained to come across as friendly and polite, but they’re not your friends. They represent the interests of the insurance company, not your personal interests. Therefore, you should only provide them with the most basic personal information, including your name, phone number, and address. While you could provide other basic details such as your occupation, you should avoid going into detail about other aspects of your life. The insurance adjuster only really needs to know the necessary basics at this stage.

Don’t Discuss the Accident in Detail

You should also avoid discussing the accident in great detail. You shouldn’t provide any information about the accident apart from when and where the accident occurred, the vehicles involved in the crash, witness information, and other basic details.

The claims adjuster may ask for additional details regarding the accident. They may also prompt you to speculate on currently unknown facts related to your case. You should never speculate or volunteer additional information and never give your opinion. Stick to the known facts of your case, and tell the claims adjuster that your investigation into the accident is currently ongoing. If you have an injury attorney, they would be best to handle this type of call.

Don’t Discuss Your Injuries in Detail

While the insurance adjuster might want to learn more about your injuries, you should never discuss them in detail until you know more about the extent of your injuries and your potential for improvement. You might have suffered injuries you aren’t yet aware of. Also, an injury you currently know about might turn out to be more severe than you initially believed. Tell the insurance adjuster that you are currently receiving treatment and that should suffice.

Don’t Allow the Claims Adjuster to Record You

The claims adjuster might ask if they can take a recorded statement. This is a common tactic that insurance companies use to trip claimants up. The insurance adjuster might even try to persuade you that you are required to give a recorded statement to obtain coverage, but this is false.

The insurance company’s intention is to try and get you to make inconsistent statements regarding the accident. They can use these conflicting statements to minimize the amount they must pay you or reject your claim altogether. Be very clear with the insurance adjuster that you will not be providing any recorded statements.

Be Wary of Quick Settlement Offers

Another tactic that insurance adjusters commonly use to minimize their losses is to make you an early settlement offer, often before many of the facts of your case are fully known. You should never accept an early settlement offer (or any settlement offer) without first consulting an experienced car accident attorney.

Early settlement offers tend to be less-than-generous. Once you sign a settlement agreement, you will forfeit your right to pursue further compensation through the insurance company. If your medical expenses or lost wages turn out to be higher than you previously thought, you could end up with significant out-of-pocket costs.

You should always consider an early settlement offer to be the bare minimum the insurance company is willing to pay. The first settlement offer is merely a starting point for settlement negotiations.

Contact New York Personal Injury Law Firm, Finz & Finz, P.C.

If you were injured in a car accident in New York, you shouldn’t have to go through the claims process alone. The New York car accident lawyers at Finz & Finz, P.C. can file your insurance claim, handle all communications with the insurance adjuster while you focus on your treatment, and negotiate a settlement on your behalf.

Our team also has the resources to conduct an independent investigation into the accident, gather evidence to back up your claim and document the damages you suffered. Having an experienced New York City car accident lawyer in your corner could significantly improve your chances of getting the full and fair compensation you’re owed.

If you’ve been injured in a car accident in New York, don’t hesitate to call us at 855-TOP-FIRM for a free case review.